End of January Real Estate Market Wrap

with Leigh Martinuzzi MPG

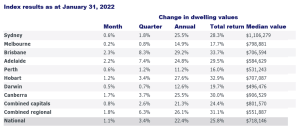

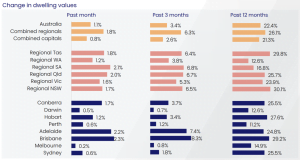

Housing values rose 1.1% over January which is up slightly up from December by 0.1%. Brisbane, Adelaide, and Canberra continue to lead the way recording growth near 2% or above (see chart below). Key constraints to a slowing rate of growth can be attributed to worsening affordability and a tightening credit market. Also, as more properties list for sale buyers have more choice and are less concerned about missing out. In Southeast Queensland, lower stock levels, continued strong buyer demand, and relative affordability continue to push prices up.

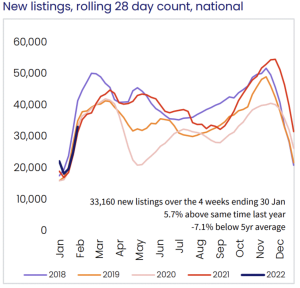

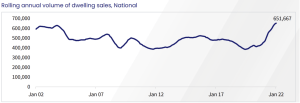

Across Australia, the number of advertised homes for sale is 20% below this time last year and 36.9% below the five-year average. However, it seems that new listings so far in January are sitting slightly up on last year by 5.7% meaning more property owners are looking to take advantage of the positive selling conditions. This is more noticeable in the increased amount of property transactions that are taking place. Total transactions increased by 15.1% in January compared to this time last year and sales are up 39.4% on the five-year average.

The question that I keep being asked is, “what will the property market do in 2022?” Mixed opinions over what will happen are evident with some people expecting a very much softening market or even a declining market by the end of the year. Many predict the banks and even the RBA will increase interest rates earlier than expected, to help soften the blow before more potential rises leading into 2023. Other experts suggest we will expect to experience a turbulent market with some suggesting dwelling growth in Australia could continue to rise until 2026. Time will tell! One thing for sure is that property owners in our local region continue to receive good strong offers in very short times on the market. Selling conditions still favour sellers.

What about the rental markets?

The national rental index increased a further 1.9% in the fourth quarter of 2021 taking the year-on-year growth to the highest recorded since 2007 at 9.4%. Regional areas continued to outperform the rental growth of our capital cities as demand in those areas continued to rise. The rental index increased by 2.5% in the December quarter compared to the combined capital city rise of 1.6% with an annual change of 12.1%. Across Australia, Brisbane has had the highest rise in rents of 2.3%.

It seems demand for housing rentals is still outperforming that of units however, this will gradually shift as asking rents for houses becomes more unaffordable. It appears the shift in remote work arrangements is creating more demand for housing over units and higher demand for larger living spaces. I expect that the raising rental expectations in our capital cities and major hubs are a key reason why demand in regional or remote areas is increasing, as renters seek affordability. Tim lawless from Corelogic explains that rental yields declined to 3.22% in December as housing value growth outpaces rental growth. You can expect better rental yields in regional locations over our capital cities.

AUCTION RESULTS STATE BY STATE (PRELIMINARY). WEEK ENDING 30th of JANUARY.

- Queensland – =81% (175/1235)

- NSW – 78% (256/1249)

- Victoria – 81% (267/1068)

- ACT – 92% (52/49)

- South Australia – 91% (125/301)

- Tasmania – NA (0/157)

- Western Australia – 100% (3/606)

- Northern Territory – 100 (1/18)

*(Auctions/Private Sales)

Review of the Week

Just too easy!

From first walking into the open house to signing the contract on our forever home. Leigh was so easy to work with and prompt with our queries. We are really happy with the whole property purchase process. He was considerate, friendly and non-pushy which is quite refreshing in this market. His passion for the Palmwoods community shines through. – Palmwoods Buyer

Professional with great local knowledge.

Leigh kept us up to date with all enquiries and gave plenty of notice for open homes and inspections. He was professional in all his dealings and communicated regularly throughout the process. We are very happy with the service he has provided. – Palmwoods Seller