Cash Rate On HOLD: Insights from Leigh Martinuzzi

Weekly Market Update with Leigh Martinuzzi MPG

The RBA recently announced its decision to maintain the cash rate at 4.35%, a move aimed at bolstering retail spending during the festive season. With new inflation figures revealing a decrease to 4.9% by the end of October 2023, analysts speculate that this decision will provide relief for consumers over the Christmas period. As we await the release of December quarter figures in January 2024, the RBA’s February meeting promises to be a crucial event, offering insights into the central bank’s strategies for the upcoming year.

A key concern is how the RBA’s decisions will influence the real estate market in the new year. The prospect of a further cash rate hike raises potential challenges for new homebuyers, making entry into the market more difficult and putting pressure on existing mortgage holders. This could result in a divergent market, with cash-ready buyers benefiting from favourable conditions while some property owners opt to hold onto their assets in the face of limited quality listings.

As of the end of November, housing prices experienced a seasonal dip, particularly noticeable in Melbourne and Sydney. However, the markets in Brisbane, Adelaide, and Perth have defied this trend, showing resilience and rapid growth. Notably, Perth’s housing values saw a significant monthly gain of 1.9% in November. The supply-demand imbalance, characterised by lower-than-average new and total listings, continues to support robust pricing in these cities.

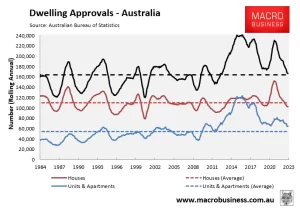

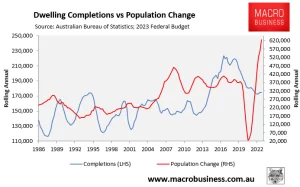

Dwelling approvals in the year to October 2023 are nearly 80,000 homes short of the government’s plan to add 240,000 new dwellings annually. This housing shortage, coupled with rising costs of goods and living, limited opportunities for land releases, and increasing interest rates, is anticipated to put pressure on builders, potentially leading to more industry challenges in 2024. Established homes, already undersupplied, will likely face further pricing pressures.

Experts anticipate that 2024 will be defined by supply shortages, historic migration highs, elevated cash rates, and a tug-of-war in property price growth. Forecasts by Domina suggest that Brisbane house prices may climb 7-8%, with unit prices expected to rise by 4-6%. On the Sunshine Coast, price increases of 4-6% for houses and 1-2% for units are anticipated. Population growth will continue to drive demand, and the rental market is poised to reach a tipping point. The government may offer incentives to buyers, and we may witness an increase in backyard dwellings and combined residency approvals.

As we approach the new year, the real estate market is set to navigate a complex landscape shaped by various economic factors. While uncertainties exist, expert forecasts suggest that record-high house and unit prices may be on the horizon for 2024. As the government seeks to balance inflation without harming the economy, we anticipate dynamic reactions in the market, with potential implications for affordability and property prices. Stay tuned for more of my weekly updates in the coming weeks.