Buyer and Seller Demand – It’s a Balancing Act!

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

Real estate markets across Australia kick back into gear as we enter February and kids head back to school. We’ve seen several new listings come to the market which is typical for this time. Although total listings are still down across a five-year average it appears buyers are currently being presented with more choices. While many homeowners who otherwise wouldn’t have considered selling are putting their hat in the ring in an attempt to sell high. And who could blame them, as we continue to see prices here on the Sunshine Coast rise?

Property prices in Brisbane for the first week of February recorded a further 0.5% gain while Melbourne, Sydney, and Perth record an almost 0% gain so far this month. Although I don’t have exact figures of growth rates on the Sunshine Coast, I can assume based on comparable rates of growth to Brisbane last year that we would be recording similar or above rates of growth. With current median house prices of approximately $800,000, assuming monthly gains of 2%, property owners are seeing their property wealth grow by a potential $16,000 per month. If, as many experts are suggesting, prices rise a further 18% this year, now is still a good time to buy.

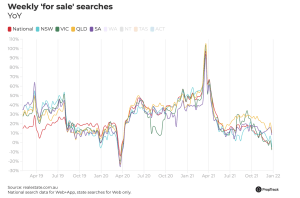

The number of searches to buy on realestate.com.au fell again last week. We have noticed a downward trend in buyer activity since October last year. Locally, buyer competition has dropped, as more choice is being presented. Also, buyers are more cautious and diligent with their decisions to purchase as the fear of paying too many creeps in. This is meaning more room to negotiate for buyers and a longer time on the market for sellers. However, this doesn’t mean buyers can be complacent. We are still seeing strong offers presented in reasonable amounts of time with most property owners still being presented with multiple offers. Likewise, I feel, homeowners shouldn’t disregard good offers if they are not quite desirable and be more willing to negotiate. The market is changing.

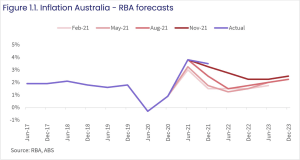

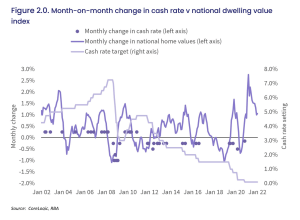

Recent inflation figures reported by the ABS are outperforming past predictions set by the RBA and this is putting upward pressure on the RBA to increase the cash rate earlier than anticipated. The idea that the cash rate could rise in 2022 is gaining consensus. When the cash rate rises we expect to see downward pressure on property prices. There is a strong correlation between the national Housing Value Index and Australia’s cash rate. The chart below provided by Corelogic is a good indication of this correlation.

With inflation rising and wages remaining rather stagnant households will be more sensitive to the rise in the cost of goods and interest rate rises. The RBA reported that in September 2021 household debt to income reached a record high of 140%. Lending parties are already showing more caution and diligence when assessing a person’s mortgage ability making sure they have enough income to cover mortgage repayments and not putting themselves into too much debt. As the cost of goods becomes more expensive, an interest rate rise will put further pressure on our disposable income which should help reduce the heat in the current economic climate.

AUCTION RESULTS STATE BY STATE (PRELIMINARY). WEEK ENDING 6th of FEBRUARY

- Queensland – 76% (158/1531)

- NSW – 85% (477/1730)

- Victoria – 82% (425/1455)

- ACT – 92% (107/76)

- South Australia – 94% (111/440)

- Tasmania – NA (0/224)

- Western Australia – 100% (4/753)

- Northern Territory – NA (1/33)

*(Auctions/Private Sales)

Review of the Week

Friendly, genuine, top agent.

Leigh was the best agent we could ask for. He was knowledgeable and professional. Leigh was friendly, easy to deal with, and kept us in the loop regularly. We felt like we could trust him to get us the best price and he went above and beyond our hopes. He was recommended to us for being a great agent and we would also recommend him to anyone looking to sell. Thanks, Leigh.