Australia’s Real Estate Market Sees Continued Growth: What’s Ahead for Buyers and Sellers?

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

The combined value of residential real estate in Australia has risen to an estimated $10.9 trillion at the end of July, a significant increase from the $9 trillion seen just before the pandemic. While growth has slowed since the beginning of the year, we are still witnessing upward movement. Future growth, however, will largely depend on what the Reserve Bank of Australia (RBA) decides to do with the cash rate. Many, including the major four banks, expect a cash rate reduction either at the end of this year or early next year. My main concern is that a drop in the cash rate may further stimulate the property market, which has been one of the main factors driving high inflation. This could lead to even higher property prices, making it harder for mortgage holders, new homeowners, and first-time buyers to access the housing market.

Demand remains strong, and the shortage of available properties is a slow-moving issue. Many property commentators agree that it will take time for supply to catch up with demand. On a more positive note, new home lending rose by 3.9% in July to $30.6 billion. According to a report by Yardley Property, Australians are now purchasing $1 billion worth of property every day. New investor loans increased by 5.4% to $11.7 billion in July, up 35% since July 2023. Owner-occupier loans rose by 2.9% to $18.9 billion, up 25%, and first-time buyer loans increased by 0.8% in July, showing an almost 20% year-on-year rise.

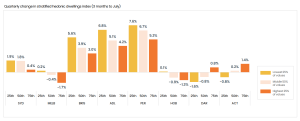

Across Australia’s combined capital cities, property prices have increased by 7.2% year-on-year, with Perth leading the charge at a remarkable 24.5%, followed by Adelaide and Brisbane at around 15%. Some areas of the Sunshine Coast have seen similar growth in property values. Interestingly, the lowest quartile of property values is showing the strongest gains, which makes sense as more buyers are pushed towards affordable options.

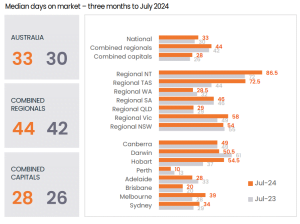

In terms of vendor activity, asking prices have risen by nearly 8% nationally over the past year, and in Brisbane, sellers are now expecting around 20% more compared to this time last year. This is a sign that vendor confidence is strong, with many holding firm on their price expectations. Although the time it takes to sell a property has slightly increased, it’s still relatively low compared to historical figures, suggesting that sellers are confident the market won’t experience a downturn any time soon.

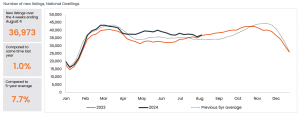

The number of new listings has slightly increased compared to this time last year, and with buyer demand remaining firm, we’re looking at a very active finish to the year. Last week, the ANZ Roy Morgan Consumer Confidence Index rose by 1.8 points to 84.1, approaching the benchmark of 85 points. This is a good indicator that overall market sentiment is improving. If we see the index break the 85-point barrier, after 85 consecutive weeks below it, we could be in for a highly active spring.