Australia’s Housing Crisis and Market Trends: What’s Happening Now?

by Leigh Martinuzzi MPG – eXp Australia

With the RBA recently announcing a 0.25% rate cut, many expected a surge in buyer confidence. However, auction clearance rates and price trends suggest that while there is optimism, buyers are still treading carefully. Te latest auction data highlights the fragmented nature of our markets, with Sydney recording a 71% clearance rate, followed by Melbourne at 67%, Adelaide at 60%, Canberra at 58%, and Brisbane trailing at 36%. These figures indicate that while buyers are returning, they remain cautious, carefully considering their purchases rather than rushing into deals.

This tells me a few things. Firstly, while the first rate cut should help improve buyer sentiment, it’s clear that caution remains in the market. We may need another cut in April to really start seeing an uplift in buyer confidence. It’s not that buyers aren’t purchasing—they absolutely are—but they’re far more selective about what they buy. The days of frenzied buying are gone. Buyers are willing to pay top dollar for homes that meet their requirements, but they’re not overextending for properties that don’t tick all their boxes.

Nationally, regional markets continue to outperform capital cities. Over the past quarter, regional dwelling values increased by 1.0%, while capital city values declined by 0.7%. In the past week, Sydney property prices increased by 0.2%, remaining flat over the month but up 1.3% year-on-year. Melbourne saw a modest 0.1% rise in the last week but recorded a 3.6% decline over the year. Brisbane remained a standout performer, with a 0.1% rise over the week, a 0.2% increase over the month, and a 9.7% jump over the year. Overall, Australian capital dwelling prices increased by 0.1% last month and are now 3.5% higher than they were 12 months ago.

With 2,820 auctions across the capitals last week—the highest volume of sales since early December—there’s no shortage of activity. Yet, despite this, high-income earners appear more confident in re-entering the market than first-home buyers. This aligns with historical trends, where rate cuts tend to have the most immediate impact on the premium property sector. While a 0.25% cut provides some financial relief, for many lower-income buyers, it’s not enough to significantly ease affordability pressures, particularly with the ongoing cost-of-living challenges.

It’s likely that the premium suburbs in Sydney and Melbourne will stabilise first, but we may also see more movement in Brisbane, Perth, and lifestyle destinations like the Sunshine Coast. If sellers remain hesitant to list, competition could push prices higher, particularly for well-presented, desirable homes. This first rate cut signals change, but whether it translates to a full-fledged market recovery will depend on what happens next.

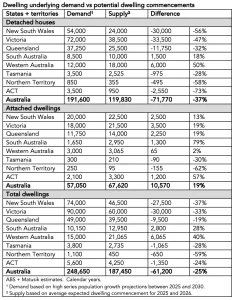

Amidst all this, a growing concern looms over the Australian property market—the worsening housing supply crisis. A recent report from Michael Matusik makes it clear that demand for new homes is far outpacing supply. His data reveals a national shortfallof 61,200 homes annually, with some states in dire straits—New South Wales falling short by 27,500 homes per year, Victoria by 30,000, and Queensland facing similar challenges. With Australia’s population continuing to grow, the pressure on housing will only intensify unless drastic action is taken. (See Chart Below)

Matusik summed it up bluntly: “Whoever is in authority, fix it or buzz off!” And I have to agree. For years, policymakers have debated housing affordability and supply, yet the issue only seems to be getting worse. It’s clear that fundamental changes are needed in the way we approach housing development.

While Australians have long preferred detached housing with space for backyards and storage, continuing to expand urban sprawl isn’t a sustainable long-term solution. Relying purely on new estates on the city fringes comes with immense infrastructure costs and challenges. A smarter approach to medium-density housing is needed—one that balances space, privacy, and functionality without compromising liveability. Well-designed townhouses, smaller lot subdivisions with efficient layouts, and innovative housing solutions that cater to modern lifestyles could provide a way forward.

If we don’t change what we build, how we build it, and where we build it, the housing shortage will only worsen. At the same time, the first rate cut alone won’t fix affordability issues. But one thing remains true—good properties in great locations will always attract buyers. If you’re thinking of selling, now could be a great time before the next rate cut brings more competition into the market.

If you’d like to know what your home is worth in today’s shifting market, reach out to me and the team at Martinuzzi Property Group for a free property appraisal. And don’t forget to check out my latest guide, The Sunshine Coast Home Sellers and Buyers Guide with Leigh Martinuzzi.