Australia’s High-End Property Market Is Volatile

by Leigh Martinuzzi

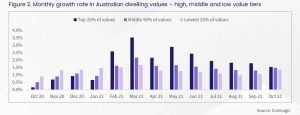

The property market growth rate across most of Australia is easing. The peak of the property market was recorded in March 2021 at 2.8% however has now settled to around 1.5% across the board. Queensland and to a slightly lesser extent Adelaide however have seen the highest monthly growth rate recorded in October of 2.5% and 2% respectively. All other capital cities are seeing a slowing rate of growth however still higher than the 5-year average which is around 0.4%. Is this a sign that we are nearing the end of an over accelerated market?

The answer to that question quite simply is, yes! With prices reaching record highs for many people affordability is a big issue that has pushed out many would-be buyers. It will take the working couple much longer now to save for a deposit big enough to afford a property in most places in Australia. There is also a tightening credit environment which will continue to place lending constraints on many buyers. And more recently property availability has increased which will push likely put downward pressure on demand.

What we’ve seen in October and since the peak of the market in March is a softening growth rate. This has been more noticeable in the high-end property market which is defined as the top 25% of the market where prices are $1M or above. The chart below highlights the peak of the top end of the market in March of 3.5% which has settled to 1.5% in October, aligned closely with the middle and low end of the markets. However, in times of boom and bust, the top-end of the market is always much more volatile.

Queensland may have now experienced its peak at 2.5% in October, which we could then assume we will see a steadying growth rate over the next six months. Once all the cashed-up buyers from our southern states dry up we will probably see a slowing market here in Queensland and on the Sunshine Coast. How long will that be? I believe we will see this by about mid-next year. My thoughts to those wondering if they should sell now or wait would be to sell now.