End‑of‑Year Property Market Wrap: Rates, Demand & Sunshine Coast Supply Tightness as 2025 Closes Out

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

Well, here we are! The final property market update for the year. And what a ride it’s been. Honestly, I never know quite what to expect next. Between media noise, shifting government incentives, and Reserve Bank decisions, the whole property space has felt like a bit of a yo‑yo in 2025.

To be fair, the three rate cuts earlier this year gave the market a strong jolt of energy. Borrowing capacity improved, confidence lifted, and the usual spring momentum came early. But I reckon it might’ve been one cut too many. Add to that the government’s first‑home buyer incentives, and you’ve got even more heat in an already competitive market. For many, especially younger buyers, that’s been helpful. For others, it’s just made affordability harder to reach and added more pressure at open homes.

Now, inflation is starting to tick up again and there’s talk that the RBA might reverse course early next year. In fact, both the Commonwealth Bank and NAB have flagged a likely rate hike when the board next meets in February. NAB’s even predicting two hikes in 2026, which could push the cash rate up to 4.1% by year’s end. On the other hand, Westpac and ANZ are saying rates might stay where they are, at 3.6%. What happens next will depend entirely on inflation data coming in over the next two months. The RBA now assesses this monthly, which at least means we’ll get quicker responses but it does add to the uncertainty.

What does this mean in real terms? Well, for homeowners, it could be another squeeze on cash flow. If you’ve got an average $600,000 mortgage, a 0.25% rise could add around $90 a month to your repayments. Over a year, that’s a couple of thousand dollars extra out of pocket and that matters, especially with other living costs still high. This sort of pressure is weighing on buyer confidence as we head into the new year, and some buyers will be hesitant to make big decisions until things settle.

But the interesting thing is that despite all this, supply remains incredibly tight especially here on the Sunshine Coast. So while some buyers might step back, plenty are still keen and ready to act, and they’re competing for fewer listings. That presents an opportunity for sellers, particularly in the December–January window. If rate hikes do come in February, it could reshape buyer behaviour, so there’s a window right now where demand is strong and stock is low.

We’re also seeing banks edge up their fixed interest rates, which is often a sign they believe the cash rate is going to rise. ANZ is still one of the more competitive lenders on paper, but as always, it pays to shop around. Speaking to brokers recently, there are plenty of sharp deals available through smaller lenders, and it’s worth doing your homework if you’re looking to buy or refinance in early 2026.

As for property prices, they appear to be stabilising as the year wraps up. 2025 has been a strong year overall as we’ve seen markets like Perth and Brisbane record price growth upwards of 13%. But more recently, Sydney and Melbourne have flattened out, and the pace of growth in the top‑three cities is starting to slow. That could be an early sign that the national market is levelling off.

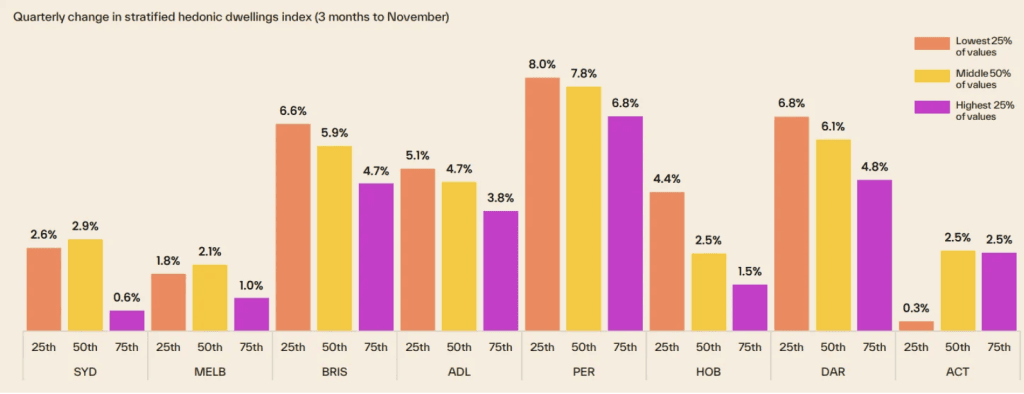

One thing that continues to stand out and I’ve mentioned this before, is the growth in the lower quartile of the market. According to recent data from Michael Yardney, that’s where the most significant price movement has occurred this year. Affordability, buyer incentives and strong demand have pushed more activity into this price bracket than any other, and we’re seeing that trend locally too. Properties under the million‑dollar mark are moving quickly here on the Coast, often selling at a premium, regardless of whether they’ve been renovated or not.

That dynamic shifts a bit in the mid-to-upper segments of the market. Buyers spending more are being pickier; they want modern, updated homes that are move-in ready. Homes needing even minor work are getting passed over in favour of turnkey properties, which says a lot about buyer priorities right now. And it reflects the lifestyle demands we continue to see. People want outdoor living spaces, media rooms, home offices, and yes, pools are still a big drawcard. But I get this question often: should I add a pool to sell my home? My advice hasn’t changed. Only add a pool if you’re going to enjoy it yourself. It may boost appeal, but rarely returns its full value at sale.

Locally, the Sunshine Coast market has stayed resilient. Listings remain tight, demand is steady, and lifestyle appeal continues to drive people into the region. There’s still strong buyer interest from Brisbane and interstate, especially from those seeking a tree or sea change. At this stage, there’s no indication that will ease up anytime soon. In fact, with land supply constrained and new development approvals still well below what’s needed, I don’t expect a meaningful increase in stock anytime soon. That shortage alone will help underpin prices next year.

As we look ahead to 2026, I’ve been gathering feedback from locals and clients about where they think the market is heading. Most expect prices to continue to rise, albeit more slowly. A few predict some softening, while others feel we’re in for a period of stability. My personal take? I don’t expect any dramatic shifts. With rate cuts unlikely, incentives largely baked in, and no surge in supply coming, we’re probably looking at modest growth. Where I previously forecast 7–10% price growth for the Coast in 2026, I’m now leaning more towards 5–7%. Still positive, just a little more measured.

The broader global picture adds another layer. In the US, economists are split. Some say aggressive rate cuts will fuel a market rebound, others point to continued economic drag. What happens there often ripples into our own market here. But for now, the Sunshine Coast remains in high demand for its lifestyle, liveability and long-term appeal.

That’s my wrap for 2025. Thanks for reading along this year! It’s been a privilege to bring you these updates each week and help navigate what’s been an unpredictable but active market. I’ll be back early next year with fresh insights and data. In the meantime, have a safe and joyful Christmas and New Year.

And as always, if you’ve got any property-related questions whether you’re looking to buy, sell, or just planning ahead, feel free to reach out. Myself and the team are here through the holidays and happy to help however we can.

Request Your Free Market Appraisal Today! 👉 Click here to book your appraisal

SUBSCRIBE to stay updated with all latest property insights and news 👉 Click Here to Subscribe

The Sunshine Coast Seller’s Guide to Choosing the Right Agent 👉 Get Your Free Guide Here

Preparing for Settlement: A Seller’s Guide to a Smooth Handover 👉 Download the Guide Here