Weekly Real Estate Market Update with Leigh Martinuzzi MPG

We are not in a recession and based on all economic indicators, it doesn’t look like we are about to be in a recession. The RBA announced a further 0.25% rise in the cash rate yesterday, which is the 10th consecutive increase taking the cash rate to 3.6%. The RBA may be underestimating the lagging impact of the rate rises. Buyers are sitting on the fence concerned about their borrowing capacity and future repayments should they purchase today. Property owners with mortgages are already feeling the pinch of increased repayments. Sellers, seeing the time it’s taking for things to sell, are hesitant to sell right now, too, and finding a replacement can be a tad tricky. And yet, the economy seems to be doing ok.

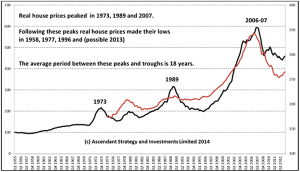

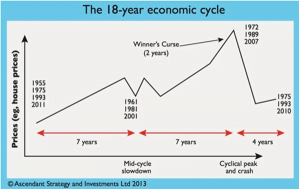

Then we have the 18.6-year market cycle. Experts believe these charts consistently highlight what the markets will do next. Right now, based on the state of the economy, they believe the end of the current cycle will be due to end close to 2025 or 2026. And these dates are for the US markets, which in Australia we usually lag. These charts have tracked the history of the property cycles for over 200 years. Perhaps there is some truth to them. Unemployment is still at record lows. And history has shown before when interest rates have increased, we’ve also seen property prices rise.

The big 4 banks are forecasting up to 7 or 8 interest rate cuts starting as early as the end of 2023. Back in 2009 until 2010, we did see a rebound in market activity. We might see a short bear market for 12 to 18 months before things start to slide in the upward direction once again. It already seems to be taking place in Sydney, where after roughly 12 months of falling prices, things are now starting to move back into positive territory. For the month of February, prices were up in Sydney by 0.3%. While modest, as Tim Lawless highlighted, it coincides with higher auction clearance rates and low levels of available stock.

Now, don’t get me wrong, it’s likely that for the next 12 months, we will see property prices continue to stabilise on the Sunshine Coast. Not falling by huge amounts, just stabilising. Yes, buyers are cautious, and rightly so, however, when I am experiencing and seeing houses go under offer within a week, cash offers being presented, and houses selling for $1M plus in Woombye and Palmwoods, I think it’s fair to argue that the market is still good. Investors are few and far between right now, and first-home buyer numbers have dwindled. If your property falls within this buyer category, the buyers need to see great value to justify the investment. The main reason is that the future of rising interest rates needs to be accounted for. Regardless, now still seems to be a fairly good time to sell, and based on these historic charts, potentially a really good time to buy with property prices potentially going to rise further over the next few years.

We are still running our March promotion for our property management services. If you have a rental property and would love world-class service and very attractive rates then please get in touch.

AUCTION CLEARANCE RATES

- Queensland – 41% (236/1157)

- NSW – 61% (949/1505)

- Victoria – 64% (958/1182)

- ACT – 51% (97/103)

- South Australia – 62% (123/343)

- Tasmania – NA (0/162)

- Western Australia – 13% (8/741)

- Northern Territory – 67% (0/36)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

THE BEST IN PALMWOODS AREA

Leigh knows Palmwoods and surrounding suburbs like the back of his hand. You can trust his opinion or advice as a buyer or seller. He’s a local who is passionate about his community. If you want to get your property sold efficiently for the highest possible price, contact Leigh – Seller