RBA Raises Cash Rate a Further 0.5%… What’s Next?

Weekly Market Update with Leigh Martinuzzi

In Australia, inflation now sits around 6%, with forecasts that it may reach nearer 8% by the end of the year. However, if the RBA’s plan works out, by lifting the cash rate, as they’ve been doing, we may see inflation drop by mid-2023 to around 5.5% and then 2.75% by the middle of 2024. Although the immediate future may look scary to many seeing big hikes in interest rates, the mid-term view doesn’t seem as bad. Of course, for now, this will continue to dampen buyer demand in the property sector, but it may not last for that long. Once consumers start to see the light at the end of the tunnel, they will be in a better position to plan and, therefore, more active with their spending. Right now, it’s just a case that we don’t know exactly what to expect next.

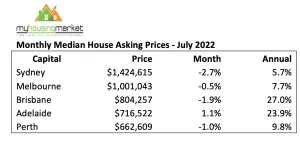

With high inflation and interest rates rising, we can see the impact this is having on property prices across our capital cities. Prices have fallen in all capital cities over the month of July, with exceptions to Adelaide (see chart below). Nationally housing prices lowered -by 1.3%. I expect we will see similar figures at the end of August before we hit the Spring market, in which I expect we will see more activity and prices holding relatively firm. You can see Auction clearance rates are up slightly on last week however, auction numbers are well down on this time last year. Regional areas, although still outperforming capital cities, have also recorded a decline in values for the July quarter by -0.8%. After an increase in values of 41% from trough to peak in regional areas, even the likes of the Sunshine Coast are now reporting slight declines in housing prices.

Although new listings for sale are still slow, they are up on this time last year. However, now that properties are taking longer to sell the number of total listings on the market for sale is higher. This is giving buyers more choices, which, on top of rising interest rates, is creating less urgency with buyer demand. The table below highlights that in general more new listings are hitting the market giving buyers a slight advantage. However, in the likes of Perth, Adelaide, Brisbane, and for us here on the Sunshine Coast, there is still a noticeable shortage of homes for sale compared to the rest of the country. I am not 100% sure how this might play out however, I may speculate that if we see houses start to sell in those states with higher-than-average homes for sale, we may see a rush of interstate buyer activity head our way. And perhaps just in time for Spring.

If you are considering making your move between now and the end of the year, please contact me to receive a copy of my book, “You Only Get One Chance”. A great guide in helping you prepare your home for sale so that you can maximise the outcome when selling.

AUCTION CLEARANCE RATES – WEEK ENDING 30TH OF JULY 2022

- Queensland – 33% (133/1116)

- NSW – 50% (339/1295)

- Victoria – 54% (583/1093)

- ACT – 48% (49/65)

- South Australia – 83% (90/304)

- Tasmania – 100% (1/166)

- Western Australia – 27%% (6/725)

- Northern Territory – NA (0/41)

*(Auctions/Private Sales)

REVIEW OF THE WEEK

Good bloke.

“I am very happy with Leigh’s professionalism and his willingness to go the extra mile in satisfying both the vendor and the purchaser. A real salesman.” – Palmwoods Buyer

Best real estate agent on the Sunshine Coast

We have sold many houses over the last ten years and have never had such a great experience with an agent prior to working with Leigh. Leigh sets a new benchmark for fellow agents within this industry, his impeccable communication skills, genuine attitude, and professionalism are second to none. Clearly passionate about getting the best result for his clients and making the buying and selling process (which we did both with Leigh) a happy and stress-free experience!! I would highly recommend Leigh to anyone that just wants to work with an honest professional to get the best results possible!! – Palmwoods Seller