The Market is Moving Again! Are We in a Supercycle?

by Leigh Martinuzzi MPG – eXp Australia

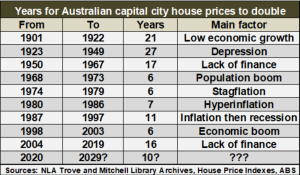

Another week, another deep dive into the ever-evolving Australian property market. Michael Yardney’s latest insights provide some fascinating takeaways on where things are heading, particularly around long-term property growth and whether we’re in a supercycle. There’s always plenty of speculation about how long it takes for property values to double, and while many still throw around the old 7–10 year rule, the reality is far more complex.

Looking at the latest market trend s, property prices have continued their steady climb despite affordability pressures and fluctuating buyer sentiment. According to CoreLogic’s recent data, Sydney property prices increased 0.1% over the last week, 0.5% over the last month, and are 1.0% higher than they were 12 months ago. Melbourne’s prices remained flat over the last week, rose 0.4% over the last month, but are still 3.2% lower compared to 12 months ago. Brisbane, however, has shown more robust growth, with prices increasing 0.1% over the last week, 0.2% over the last month, and 9.1% higher than they were 12 months ago. Overall, Australian capital dwelling prices increased 0.4% over the last month and are now 3.1% higher than they were 12 months ago.

Interest rates are already on the way down, with the Reserve Bank of Australia announcing a 0.25% cut just a few weeks ago—the first in five years. Another cut is widely anticipated at the RBA’s next meeting on April 1, with more expected over the next 12 months as inflation returns to manageable levels. Historically, when interest rates drop, borrowing power increases, leading to heightened buyer demand. We’re already seeing renewed confidence creeping back into the market. However, with stock levels still low and listings 2.9% below this time last year, there’s a growing risk of increased competition driving prices higher, particularly in sought-after locations.

One of the longest-standing myths in real estate is that property prices always double every 7–10 years. While there’s certainly historical evidence of strong long-term growth, the latest research shows that markets move at different speeds, influenced by economic conditions, supply constraints, and local demand. Some areas have doubled in value in as little as six years, while others have taken 15 years or more. This just reinforces what most experienced investors already know—Australia isn’t one market but a series of independent markets moving through different cycles.

One of the more interesting discussions happening right now is whether we’re in a supercycle. Some experts believe we’re seeing an extended period of above-average growth, driven by record-low housing supply, rising migration, and continued infrastructure investment. If that’s the case, we could see property prices rising more rapidly than previous cycles, particularly in high-demand locations where supply simply can’t keep up with buyer interest. With Australia’s population surging by 550,000 people last year alone and new housing construction lagging behind projections, demand is likely to remain strong, putting further upward pressure on prices.

On the Sunshine Coast, I for one felt like we were getting close to peak prices, and then the market shifts, and prices rise again. Over the last few months alone, we’ve seen a new jump in prices, with some sales results sitting well above market averages. Just when you think things are slowing, suddenly prices spike again—perhaps this really is a supercycle. The region remains one of the most resilient and desirable markets in the country, thanks to a combination of tight supply, lifestyle appeal, and strong demand from both local and interstate buyers. Unlike capital cities, where affordability constraints and rising stock levels may slow growth, the Sunshine Coast benefits from its limited availability of land and increasing migration from southern states. With more people seeking a sea change away from Sydney and Melbourne’s congestion, the Sunshine Coast is well-positioned to stay ahead of the curve in this next market phase.

All of this leads to the age-old question—when is the right time to buy? The truth is, no one can predict the market with absolute certainty. There will always be external factors that shift the landscape, whether it’s interest rate changes, government policies, or global economic trends. However, history tells us that when rates drop, competition rises, and buyers flood back into the market. Waiting on the sidelines for the perfect moment often leads to missing out, especially in tightly held markets like the Sunshine Coast, where demand continues to outpace supply.

The property market has always moved in cycles—some with rapid growth, others with slower gains—but one thing remains true: over time, values increase. Whether this is a supercycle or just another strong phase of growth, the fundamentals don’t change. Location, demand, and timing continue to play the biggest roles in investment success. If you’re thinking about making a move, now is the time to consider your options. Reach out to me and the team at Martinuzzi Property Group to discuss how we can help you navigate the market and make the most of the opportunities ahead.