Spotlight on Property Trends: Charts & Insights Shaping Australia’s Housing Market Outlook

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

This week, I want to take a closer look at where the Australian housing market stands and what the current trends might suggest about the next 6-12 months. Thanks to CoreLogic’s latest research, we’ve got some valuable insights to share.

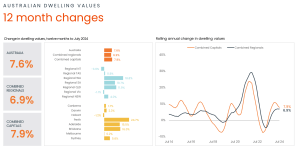

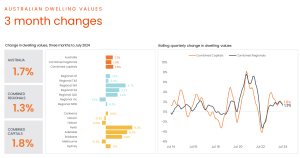

Over the past three months, property values have risen by 1.7%. This marks a noticeable slowdown compared to the 3.3% growth reported in the June quarter of last year. Annually, prices have increased by 7.6% across Australia, which is down from the February 2024 figures of 9.7%. These trends indicate that the market is beginning to stabilise, with strong signs of price stabilisation in the rental sector as well.

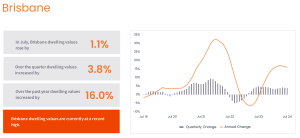

It’s important to note that these figures are somewhat skewed, with certain markets outperforming others due to supply limitations and relative affordability. Brisbane, Perth, and Adelaide continue to be the standout performers, although growth trends are slowing even in these areas.

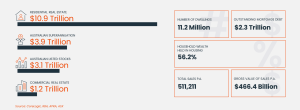

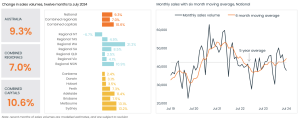

Annual sales volumes have dipped slightly, which might be expected at this time of year, with CoreLogic reporting 511,211 sales. However, total sales volumes are up 9.3% from this time last year and 5.1% above the five-year average. Some areas, particularly in Western Australia, are experiencing hotter markets, as reflected in the chart below. What’s interesting is the apparent trend of homeowners in more affluent areas selling up and moving further afield. Whether it’s to escape the hustle and bustle brought on by rapid population growth or to find more affordable areas to reduce debt, this migration is significant.

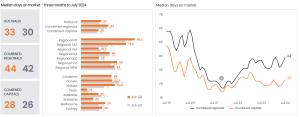

On average, the time properties spend on the market has extended slightly, now sitting at 33 days, up from 27 days in the last quarter. Here in the Sunshine Coast hinterland, the average time on the market ranges from 30 to 40 days. Of course, this is just an average—properties that represent good value are still being snapped up quickly, while those in higher price ranges or that don’t present as well are taking longer to sell.

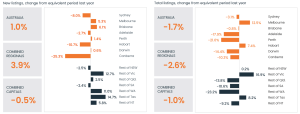

We’ve also seen an increase in listings, which is somewhat unusual for this typically slow period. In the four weeks leading up to August, new listings increased by 1% to 36,973 dwellings, which is 7.7% above the five-year average according to CoreLogic. However, on a national level, total listings are still -15.9% below the five-year average and -1.7% below this time last year, with current dwellings for sale sitting at 136,135. Particularly in Western Australia, Queensland, and South Australia, the number of homes available is significantly below historic averages, which is helping to keep prices buoyant in these areas.

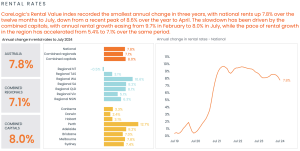

On the rental front, prices have stabilised and have even fallen slightly, with the exception of some regional markets where rental fees have climbed from 5.4% to 7.1% in the past quater.

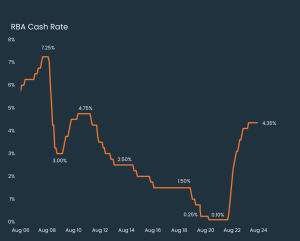

Regarding interest rates, we know that the cash rate remains on hold at 4.35%. This is similar to the levels we saw back in 2010 when the RBA raised the cash rate in an attempt to stabilise the market following the rate cuts during the 2008 financial crisis.

Looking ahead, the market heat that began during COVID appears to be stabilising. I believe areas like the Sunshine Coast, WA, and SA still have room for further growth, although in my experience, our growth tends to lag behind that of the larger capitals. Affordability and cost of living pressures are becoming increasingly noticeable. That said, here on the Sunshine Coast, prices have continued to rise over the past year, and for most properties, good offers are still being received quickly, allowing owners to move on swiftly.

Historically, conditions are still favourable for sellers right now, but if these trends are any indication of what’s to come, we might see some changes on the horizon.

As always, stay informed and feel free to reach out if you have any questions or need advice. I’m here to help you navigate these market shifts.