South East Queensland Real Estate

Supply Vs Demand, and What it Means for You – Market Update with MPG

In the world of real estate, it’s pretty clear that folks are clamouring for homes in South East Queensland (SEQ), and our government is struggling to keep up. Here are the simple facts: We need about 900,000 new houses to make room for 2 million more people expected by 2046. But last year, we only managed to register 1800 new lots. To meet the demand, we should be adding at least 4330 new homes every year.

The numbers tell a story. From March 2022 to March 2023, Queensland’s population grew by a whopping 124,000. This huge gap between what people need and what’s available is a big reason why house prices keep going up.

Let’s focus on Brisbane. Since the start of 2020, house prices here have shot up by 51%. This year, they’ll probably go up by another 12%, and the National Australia Bank (NAB) predicts another 6.5% increase next year. So, what’s driving these price hikes? A lack of supply.

And inflation isn’t coming down quickly enough, which has many concerned that another rate increase is on the cards. Gas prices, the cost of building, rent, taxes, and electricity—these all play a role in high inflation. Matusik suggests (and I agree), raising the interest rates could make inflation worse. When interest rates go up, so do mortgage payments, and landlords often pass that on to renters. So, for now, it might be a good idea to keep those interest rates where they are. But we’ll see what happens in the future.

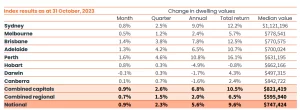

Now, let’s talk about house prices. They’ve gone up 0.9% across the country in October, which means we’re just 0.5% away from the highest point in April 2022. Perth, Adelaide, Brisbane, and Sydney are leading the way, with returns of 10% or more. Meanwhile, regional areas around the country are growing more slowly. However, in some regional areas around Queensland we’re still seeing some pretty strong growth, especially outside of South East Queensland.

As for renting, the prices are going up too. In the September quarter, they went up by 3.8%, and over the year, it’s a whopping 14.6% increase. The reason? We just don’t have enough places for people to rent.

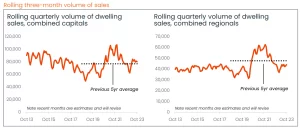

Now, there are more homes up for sale, and we’re seeing more new listings. But the situation isn’t the same everywhere. Big cities are getting more listings, with Sydney and Melbourne leading the pack with nearly 10% growth. Brisbane, though, has seen only a slight increase of 0.5%. In most big cities, we’re selling a bit more than usual, but in regional areas, sales are slowing down. As we see more homes for sale, things should start balancing out.

On the bright side, folks are feeling better about buying homes. Many are tiptoeing back into the market, but they’re still thinking hard about what they can afford. Here in South East Queensland and on the Sunshine Coast, there’s still a shortage of homes for sale, which is keeping prices firm and in some cases moving up.