Real Estate Market Update – Steady Growth Amid Slowing Momentum

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

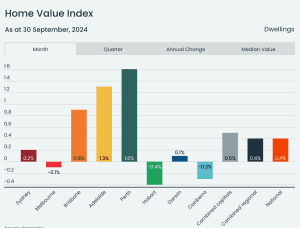

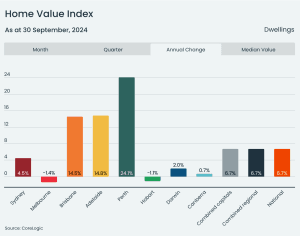

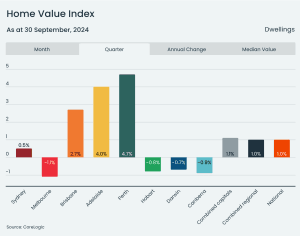

The property market’s momentum continued to slow in September, with price growth of just 0.4% following a 0.3% rise in August. Over the September quarter, values rose a modest 1%, marking the slowest rate of growth since the March quarter of 2023. Several capital cities, including Hobart, Canberra, Tasmania, and Darwin, recorded negative growth for the quarter. Meanwhile, Brisbane (2.7%), Perth (4%), and Adelaide (4.7%) are the mid-size capitals driving most of the market’s growth.

According to CoreLogic, listings have increased, with new advertised stock up 3.2% from this time last year and 8.8% above the five-year average. Tim Lawless noted that the fresh stock hasn’t been this high since 2021, with more sellers eager to get their properties on the market. This could be a signal of worsening consumer sentiment and a shaky economic outlook.

Auction clearance rates have dipped to around 60%, with the average time on the market rising slightly to 32 days from 29 days. Affordability continues to put a strain on the market, with the lower quartile of property prices seeing the most significant growth—up 12.4% over the last 12 months, compared to just 3.8% in the upper quartile. On the rental front, price increases have slowed significantly, with the national rental index climbing just 0.1% over the September quarter.

So, what’s driving this slowdown? The key factors are affordability and the rising cost of living. Higher interest rates are pushing many first-home buyers out of the market, with demand focused on more affordable homes, hence the strong growth in the lower price brackets. As affordability worsens, demand softens. Furthermore, immigration numbers have slowed, with overseas migrant figures for the March quarter of 2024 just above 133,000—down by 31,700 compared to the previous year.

Cost of living pressures and increased mortgage repayments are also curbing consumer spending across the board. In speaking with local business owners, many have reported slower-than-usual business activity. This slowdown is precisely what the RBA intended with the 13 consecutive rate hikes. With the festive season approaching, I don’t foresee further rate increases—if anything, we could even see a rate cut. Elections are also on the horizon, which gives me more confidence that a rate cut is likely before March 2025.

In the United States, the Federal Reserve just implemented a 0.5% rate cut to stimulate their softening economy—their first since 2020. This aggressive move shows their desire to kickstart spending, and I feel Australia may follow a similar path. This boosts my confidence that we’ll see a rate cut within the next six months.

What does this all mean for buyers and sellers? While demand has softened, sellers are still able to hold firm on their asking prices, and properties are achieving strong sale prices. There’s little urgency from sellers to offload properties, especially on the Sunshine Coast, where there are fewer forced sales. Presenting a home that represents good value remains key to attracting serious buyers. Neat, tidy homes in good condition are attracting the most interest, while properties that need work are still getting attention but at more competitive price points.

Demand for homes on the Sunshine Coast seems to be on the rise, with more interstate and Brisbane-based buyers seeking opportunities in the area. Spring is shaping up to be busy, and I expect a flurry of activity leading up to Christmas. For buyers and sellers, now could be an excellent time to make your move. The uncertainty of 2024’s economic landscape could impact sales activity, and if interest rates do fall, increased competition from buyers could inflate prices even more.

At Martinuzzi Property Group, we’re here to help you live more fully, have more meaning, and find more joy on your next property journey.