Property Market Challenges & Median House Price Growth Since 1975

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

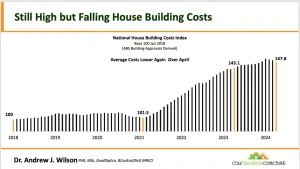

As we navigate through mid-2024, the property market is facing some significant challenges and changes. One of the most notable issues is the cost to build new homes, which is now 40% higher than it was before the COVID-19 pandemic. This increase is driven not only by higher material costs but also by rising labour costs. Larger projects are absorbing key talent, making it more challenging and expensive to build homes. (Chart below)

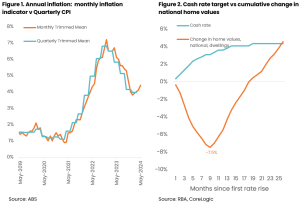

Recent Consumer Price Index (CPI) data revealed a 4.4% inflation rate for May, up from 4.1% in April. This increase has triggered discussions about another potential RBA cash rate hike. This persistent inflation, combined with low housing supply relative to demand, is a cause for concern. Strong population growth has increased the demand for housing, both for purchase and rent. However, the tight labour market and rising building costs are impacting the viability of completing existing projects.

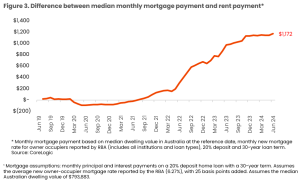

Another potential rate rise could push average mortgage repayments above $4000 per month, up from $1,172 in June to $1,276 in August. This would be a significant burden for many homeowners.

In the June quarter, approximately 127,000 homes were purchased, but only about 125,000 new listings were recorded. Despite the market’s resilience, demand is already weakening, evidenced by a 1.8% growth in the June quarter, down from a 3.3% rise this time last year. The current growth is being heavily influenced by markets such as Perth, Adelaide, and Brisbane.

A brief look at the current supply and demand situation thanks to Matusik.

- Detached House Sales vs. Stock for Resale: We’ve got 20,000 detached houses listed for resale, with annual sales reaching 48,500. This translates to a lean supply of just 4.9 months, indicating high demand and a hot market.

- Apartment & Townhouse Sales vs. Stock for Resale: Currently, 9,100 apartments and townhouses are up for resale against 49,000 annual sales, resulting in a razor-thin supply of 2.2 months. This market is moving fast—blink and you might miss out! The days of an oversupplied SEQld apartment market now seem like a distant memory.

- Vacant Dwellings for Rent & Residential Vacancy Rate: On the rental front, the competition remains fierce. With only 5,200 vacant dwellings, the vacancy rate stands at a mere 1.0%.

Looking back, Sydney’s median house price has increased 27 times since 1975, when it was $28,000. Today, it’s $1,170,152. If wages had kept pace with this growth, the average wage would now be $162,000, compared to around $6,000 in the mid-1970s. It should be noted that there are also more 2 income households now that are helping with increased living costs. The standard variable interest rate in 1976 was 9.88%.

The expectation for the coming year is a slowing of price growth, with estimates ranging from 4 to 6% being fairly realistic. While supply has increased in recent months, the overall shortage persists and looks as though it will continue to persist in the years ahead. Until we can get inflation under control, I expect that the uncertainty with regards to the economy and property market will remain. All things aside, the Australian property market remains resilient with sellers having the upper hand in most markets across Australia.

One final chart – Cash Rate and Property Prices