Insights and Updates: Brisbane’s Booming Property Market

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

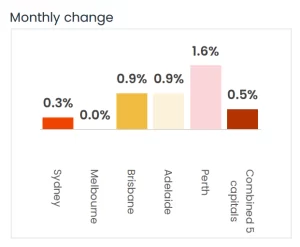

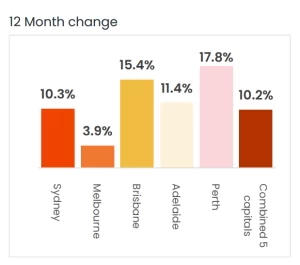

Prices in Brisbane are on a tear! Would you believe they’re a whopping 15.4% higher than this time last year? Compare that to Sydney and Melbourne, still showing growth but with 12-month increases of 10.2% and 3.9% respectively. It seems the dire forecasts from the RBA and other experts a year ago missed the mark by a long shot. The combination of sky-high demand and a shortage of quality properties continues to fuel the rise in both housing and rental prices.

And here’s the kicker: while price growth has been tapering off lately, I’ve got a strong feeling things are about to take a turn. It’s not just a gut instinct either. Auction clearance rates are through the roof, and I’ve noticed a significant uptick in buyer numbers and inquiries over the past few weeks. With interest rates holding steady and whispers of a potential rate cut later this year, it’s no wonder buyers are feeling more confident. Now might just be the perfect time to dip your toes into the market.

Meanwhile, Perth and Adelaide are still outshining other capitals, driven mainly by housing affordability. Check out the charts below for a snapshot of each capital city’s performance.

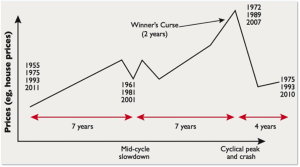

Now, let’s talk about those market growth cycles. I may have goofed in my vlog by mentioning a 26-year cycle (oops!), I meant the 18-year cycle. I’m feeling more confident that history might just repeat itself. The last market bottomed out in 2010, signalling a peak expected around 2028. That gives us a few more years of growth, especially considering the contributing factors I’ve discussed in recent weeks. It all boils down to supply, demand, and the current economic climate.

And speaking of economic climates, it seems the US is gearing up for some interest rate cuts very soon. My colleagues across the pond are predicting a whirlwind of activity, and history tells us we typically follow suit about 6 to 12 months later.

That’s a wrap from me this week. Keep your eyes peeled next week for my updated suburb reports kicking off the month. Until then, happy buying and selling.