How a Cash Rate Cut Could Impact Property Prices Amid Australia’s Housing Shortage

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

In this week’s real estate market update, I’ve been following a lot of buzz around the potential impact of the RBA lowering the cash rate. When inflation is high, we know the RBA steps in, like it did recently with 13 consecutive rate hikes to cool the economy. Now that inflation is starting to ease, we’re hearing more about the possibility of a rate drop to prevent a recession. If the RBA does cut the cash rate soon, it will stimulate spending, and the property market is likely to see a jump in demand as borrowing capacity increases and mortgage holders find a little more room in their budgets. In past instances, such as 2011, property prices in cities like Sydney rose by over 1% in just a month following a rate cut. It’s reasonable to expect similar results when the next rate cut comes.

But this price increase may be short-lived. Affordability remains a big issue, especially as prices rise while wages lag behind. For many buyers, the current property prices are already stretching budgets thin. The affordability challenge is clear in housing supply data. On top of that, Australia is facing a major housing shortfall, with 176,000 dwellings completed by June 2024—well below the government’s target of 240,000 annually for the next five years. The slowdown in new construction is largely due to increased costs, which are up almost 30% since COVID. And although costs seemed to be stabilising they’ve jumped up from the June quarter to the September quarter 2.6% to 3.2%. This has made it difficult for builders to maintain profit margins. With approvals down, this shortage of supply could put further pressure on housing prices, but also on unemployment, as construction is a key driver of jobs.

Government intervention is being discussed, potentially stepping in to ease the costs of infrastructure for developers, which could help some ready-to-go projects move forward. However, I’m cautious about whether these savings will really benefit buyers or just increase developer profits, as we’ve seen in the past.

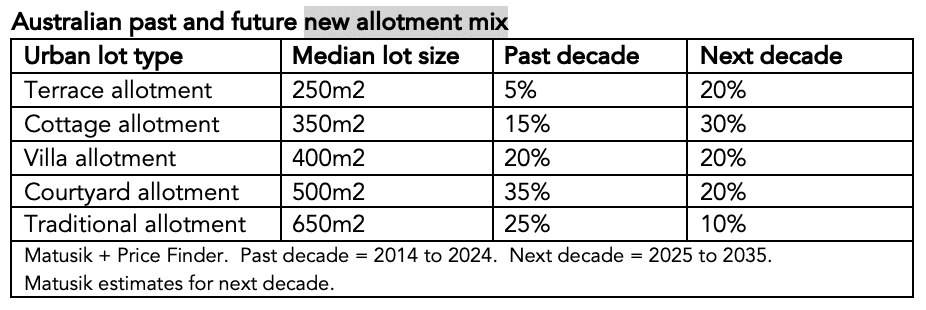

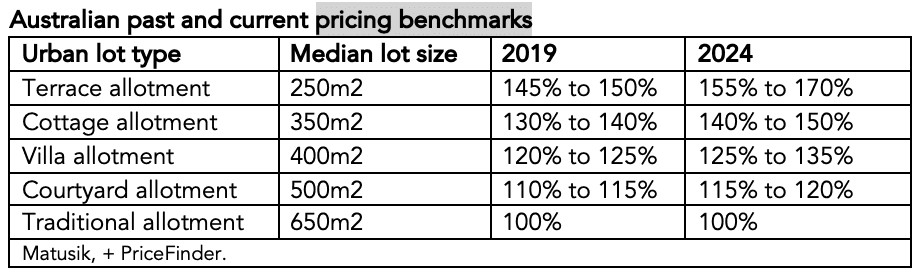

On a broader scale, Matusik recently reported a trend toward smaller lot sizes and homes over the next decade. This shift could help first-home buyers enter the market, offering more affordable options. With modern lifestyles focused more on work, social activities, and tech, smaller homes might appeal to buyers looking to spend less time maintaining properties and more time on other pursuits. However, as land sizes shrink, price per square metre could increase, adding another layer to the affordability discussion. (Charts by Matusik below)

As always, the market remains a fascinating space to watch, especially as we navigate these changes. Stay tuned for more insights!

Feel free to download our latest Property E-magazine too using the link below. Full of interesting insights, properties and other goodies just for you. – https://publuu.com/flip-book/576400/1498458