Has Queensland’s Property Market Reached the Peak?

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

According to CoreLogic, last week was the busiest week in February on record since back in 2008. Despite the war in Ukraine, floods, and talk of an interest rate rise the buyer frenzy continues. Although, we know what happened to the property market after 2008… the bubble burst!!

There are many transactions taking place at the moment with buyer demand helping things keep momentum, however, signs of slowing are very apparent. Auction clearance rates in Sydney and Melbourne while still in the 70s have slowed as more properties come up for sale. For the month of February so far, these two capital cities have seen property prices remain flat. Brisbane and Adelaide on the other hand are still bringing in positive gains of 1.9% and 1.5% respectively. This is a slight drop from what they experienced in January. Early signs that the Queensland property market is starting to shift.

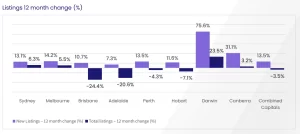

As you can see in the chart below there is a significant decline in total listings in Brisbane compared to this time last year, down 24.4%. However, new listings coming online over the same four-week period is up 10.7% on this time last year. While buyer demand remains strong and total listings experiencing a shortfall, we can expect prices to hold a little longer. As more new listings hit the market buyers understand they have more choice. On top of increasing uncertainty about the future of the property market, buyers are less willing to go above and beyond to secure a property.

If you are selling now, you can be certain that the offers you do get are going to be top offers. We need to understand buyers are less likely to have bidding wars in the fear of missing out and therefore price expectations need to be aligned with current market values. My advice, be ambitious but not unrealistic. Multiple offers are still being received and fair market value is easily identified within a couple of weeks.

Tim Lawless, director of research and CoreLogic, has suggested that Australia’s capital cities and broader regional areas are now all recording a slowing growth trend. Nationally property prices rose a further 0.6% however this is the lowest growth reading since October 2020 and a definite continued downward trend since the peak rate of 2.8% in March 2021. The Sunny Coast market remains buoyant however, I think we can expect a slowing market as we move into 2022.

AUCTION RESULTS STATE BY STATE (PRELIMINARY). WEEK ENDING 27TH OF FEBRUARY

- Queensland – 73% (160/1568)

- NSW – 91% (715/1702)

- Victoria – 83% (1031/1547)

- ACT – 88% (113/87)

- South Australia – 94% (126/425)

- Tasmania – NA (0/217)

- Western Australia – 67% (3/831)

- Northern Territory – 100% (3/28)

*(Auctions/Private Sales)

Review of the Week

Fantastic Service

“We found Leigh to be a determined agent who was always punctual. He communicated with us daily and kept us up to date throughout the entire sale process. Our property wasn’t an easy sell however Leigh went above and beyond to ensure it was a smooth process for us. We would definitely recommend Leigh for those considering selling their property. – Palmwoods Seller

Great communicator

Dealing with Leigh was amazing. He constantly kept me updated with the progress of our campaign and consulted with me regarding any decisions that needed to be made, whilst advising me regarding the current property climate. I found Leigh to be a very trustworthy and reliable agent. – Palmwoods Seller