Cash Rate Increase by 0.25%! National & Local Market Update

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

The RBA announced its ninth consecutive cash rate increase this week, raising it by 0.25% to 3.35%. Their attempts to pull back inflation continue, and, on all accounts, it appears to be working. It is causing uncertainty amongst both buyers and sellers, with many sitting on the fence waiting to see what happens over the next few months. Major financial decisions will remain on hold while there is a large degree of economic uncertainty.

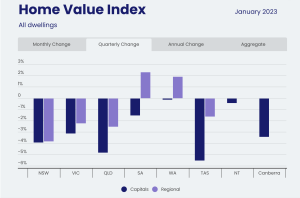

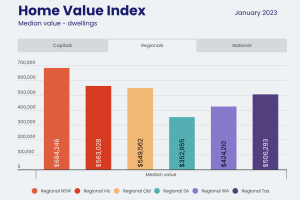

The National Home Value Index is showing signs of easing, with national house prices down -1% in January, an improvement on December’s decline of -1.1%. The figures vary across our capital cities, with Hobart leading the way, down -1.7%, and Brisbane trailing close behind, down -1.4%. It seems regional areas are seeing a lesser decline in property values, with capital cities seeing larger falls. Since dwelling prices peaked in June, regional areas are reporting a decline in values of -7.4%, while the combined capital cities are now down -9.6%. The premium end of the market, which experienced earlier and larger upswings in prices, has seen an easing rate of decline. In the three months to January, prices were down 4% as opposed to the September quarter, which saw prices down -6.1%. Further signs of a stabilising market.

What is to be noticed is the lower than an average number of new listings coming to the market for sale. In spring, Australia saw a significantly reduced number of properties coming to the market for sale and the trend so far in 2023 seems to be continuing. While buyer demand is down, this may be good news for those who are looking to sell. With fewer choices, buyers will have less negotiating power. Buyers, however, will still be less inclined to pay premium prices with interest rates still on the rise. In the four weeks to the end of January, new listings were down -22.2% on this time last year and -24.5% below the five-year average. Property transactions are also down, with property sales over the past three months down an estimated -29.4% in the same period last year, and -11.5% below the five-year average.

Based on all this, here is my take on what we are experiencing locally on the Sunshine Coast. The premium sector are still seeing confident offers and sales prices being achieved. The mid-range of the market is a slower burn. Properties that present great value are still being snavelled up relatively quickly and for good prices. In the bottom sector, we are seeing more demand, however buyers are still showing caution, and many are making offers below price expectations that may have been seen over the past couple of years.

I feel as though we can expect to see more buyers out looking at properties for sale, and with less homes on the market for sale, these numbers might seem heightened. While there will be a few ready-to-go buyers in the mix, many will be doing research and assessing affordability and value while they wait to see what the market does over the next few months. We then may see a surge of transactions take place around Easter or perhaps even a bit before mid-year. Sellers will most likely need to adjust their price expectations slightly if they wish to achieve a good result. And without distressed sales, prices are unlikely to fall a great deal further. As a matter of fact, many buyers may be caught of guard and even see property prices begin to rise again later this year with more significant price gains in the years after 2023.

AUCTION CLEARANCE RATES

- Queensland – 33% (254/1088)

- NSW – 59% (586/1274)

- Victoria – 64% (438/1031)

- ACT – 59% (134/81)

- South Australia – 68% (116/311)

- Tasmania – NA (1/152)

- Western Australia – 22% (9/759)

- Northern Territory – 33% (3/32)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

A very complex purchase made easier by Leigh

The purchase of our new home was a very complex situation due to multiple sellers being involved, etc. Leigh worked closely with us the interested parties and after much back and forth and many conversations and negotiations we managed to get the contracts signed with all parties on board and happy. He was respectful and listened to what we wanted and worked hard to get us our dream home. Thanks Leigh! – Buyer