Australian Property Market Update – February 2025

With Leigh Martinuzzi MPG – eXp Australia

As we move further into 2025, Australia’s property market continues to show an intriguing mix of stability and shifting trends. The latest data reveals that while national home values remained mostly steady in January, there are notable movements happening across capital cities and regional markets. Understanding these shifts is crucial for buyers, sellers, and investors navigating the ever-changing real estate landscape.

National Property Values Hold Steady

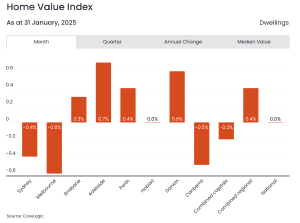

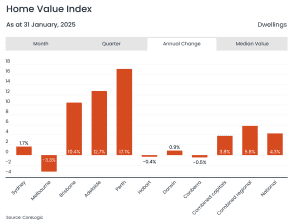

In January, national dwelling values saw only a minor change, dipping slightly by 0.03%. This stabilisation comes after a year of strong growth in 2024. However, while the overall market remained balanced, the picture was quite different when comparingcapital cities to regional areas.

The combined capital cities recorded a 0.2% decline in home values. In contrast, regional markets outperformed their metropolitan counterparts, posting a 0.4% increase in dwelling values. This rise has pushed regional property values to new record highs, a continuation of the trend where more Australians are looking outside major cities for affordable living, lifestyle benefits, and work-from-home flexibility.

Capital Cities: A Mixed Bag

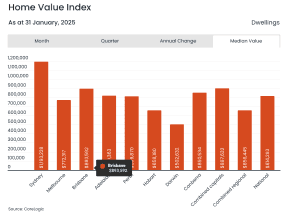

Not all cities performed the same, with some experiencing notable declines while others continued to grow:

- Melbourne was the weakest performer, with home values falling by 0.6%.

- Canberra (ACT) and Sydney also saw declines, dropping 0.5% and 0.4%, respectively.

- Hobart remained unchanged, showing no movement in dwelling values for the month.

On the other hand, some cities continued their growth streak:

- Brisbane and Perth both recorded price increases, reflectingcontinued buyer demand in these markets.

- However, the pace of growth in detached housing is slowing down, particularly in Brisbane, where affordability constraints may be beginning to take effect.

These capital city trends indicate that while some markets are cooling, others are still seeing strong demand, particularly where housing remains relatively affordable.

Regional Australia Leading the Charge

While some capital cities struggled in January, regional Australia was the standout performer. Regional markets pushed to new record highs, continuing their upward trajectory. With an average 0.4% increase in dwelling values, many areas outside the major cities continue to attract buyers priced out of metro markets or seeking a better lifestyle.

Several factors are driving this trend:

✅ More Australians are prioritising lifestyle and space, choosing to live in scenic hinterland areas or coastal towns.

✅ Hybrid and remote work options are allowing people to move further from their workplaces while maintaining employment.

✅ Property prices in regional areas remain more affordable compared to major cities, despite strong recent growth.

What This Means for Buyers and Sellers

- For buyers: There are still opportunities, especially in regional markets where prices continue to rise. If you’re looking in metro areas, watch for softening prices in cities like Melbourne, Sydney, and Canberra.

- For sellers: If you’re in regional areas or high-demand capital cities like Perth and Brisbane, the market remains in your favour. If you’re in Melbourne or Sydney, strategic pricing and strong marketing will be essential to achieve the best outcome.

Looking Ahead

As we head further into 2025, market conditions will likely continue to shift. Interest rate stability, affordability constraints, and supply levels will all play a role in how the property market unfolds in the coming months.

If you’re considering buying, selling, or investing, it’s essential to stay informed and make data-driven decisions.

💬 Want a free property market report or a chat about your real estate goals? Click here to learn more 👉 MPG Real Estate

For more insights, check out my 2025 Market Forecast for the Sunshine Coast here: