With Elections Announced What’s Ahead of Us?

Weekly Real Estate Market Update with Leigh Martinuzzi

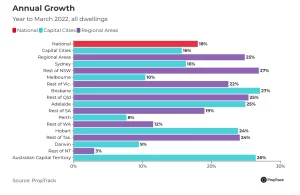

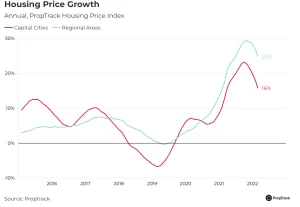

Dwelling prices in March grew 0.34% nationally, which is approximately half the national average over the last decade. However, regional areas, like the Sunshine Coast, continue to outperform our capital cities, with growth rates reported over March of 0.24% compared to 0.62% in regional Australia. Annual growth figures at the end of March saw capital cities’ prices grow 15% nationally, while regional areas for the same period reported a 24% growth. We’ve passed the peak of the market as seen in late 2021 and property price growth is now flattening out. Elections are on the way and continued talks of rising interest rates may be the cause for many property sellers choosing to list their property now rather than waiting until later in the year.

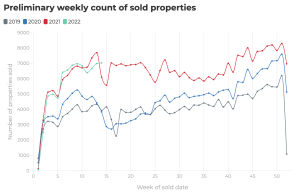

Last week’s auction volumes across the country were the largest seen this year however, according to many experts this is typical for this time of the year. Many property owners choose to sell before the Easter holidays. Although clearance rates are lower, nationally at 76% compared to 86.2% this time last year, sales volumes are still high. Sales volumes recorded in the first 14 weeks of 2021 are almost on par with sales volumes in the first 14 weeks of this year and are 39% greater than the same period in 2020. With news headlines reporting that interest rate rises could cut 15% from house prices, many buyers and sellers have more urgency to transact now rather than wait until later in the year.

Most banks have already risen their borrowing rates this year particularly the fixed mortgage rates. Since my quarterly report in January, the average mortgage rate is now 2.5% across most lenders with fixed rates up from 2.49% to 3.3%. If you look at the average house price locally of around $800,000, monthly repayments, assuming a 20% deposit, are $3,146. Of course, the variable rate is lower at 1.99% however most buyers are choosing to fix their loans to avoid higher rates that may come later in the year. Naturally, people will be more cautious about spending and borrowing with higher interest rates forecast, however, I am hesitant to think it will be great enough to see a market crash with a significant price drop. If anything, I feel that this year we will simply see prices flatten and times on the market push out as buyers continue to be greeted with more choices.

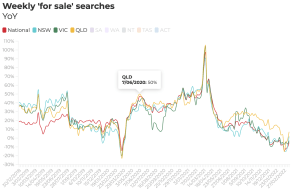

The election and the end of the financial year almost always see increased uncertainty and changes in market supply and demand. So far, none of the major parties has announced housing policy changes that have any negative effect on the property market. I am confident with the increased knowledge of future interest rate rises, property supply will continue to strengthen until mid-year. Buyer demand is also slowing with REA insight sharing a drop in property searches by 8% from February to March and 11% year on year. Recent flood events in Queensland and NSW may have some impact on these figures however it appears property searches have rebounded significantly in the last week. Locally we’ve experienced a higher volume of buyers attending inspections while email enquiries are slightly down. REA has reported a 6.1% decline in views per listing in Queensland which is likely due to an increase in property availability, a trend we’d expect to see an increase as we move further into 2022.

Where to from here? Regional areas will still attract higher buyer demand throughout the year and likely result in better prices and conditions throughout the year despite any impacts from rate rises. Buyers will welcome more property availability yet still have urgency to purchase while buyer demand is expected to remain relatively strong. Property owners will need to be more negotiable with their sale price as it is unlikely that price growth will continue to move upward but rather flatten out. Capital cities will more likely see declining price growth however the unit sector might have an upward swing as they represent more value than house prices.

Did you see these stats last week?

Local & National Property Statistics

MPG Statistics 2021

- Median Sold Price = $861,000

- Average Days on Market = 14 days

- Total Properties Sold (12 months) = 47

- Total Sales Volume = $27.57M

- Palmwoods #1 Agent 3 Years Running (RMA)

- Rated #3 Most Reviewed Agent Sunshine Coast

- Most Reviewed Agent in 4555 (REA)

Palmwoods Snapshot Stats

- House Value Increase (Annual) = 44%

- Median House Price = $800,000

- Average Weekly Rent = $580 pw

- Average Days on Market = 27

- Properties for sale = 20

- Total sales year to date = 27

National Statistics

- Annual House Value Increase = 18.2% (annual)

- March Quarter Increase = 2.4%

- Combined Capital Cities = 1.5% (March Qtr.)

- Combined Regional areas = 5.1% (March Qtr.)

- Average Time on The Market = 36 days

Auction Clearance Rates (Preliminary). Week Ending 10th of April

- Queensland – 72% (156/1449)

- NSW – 86% (764/1615)

- Victoria – 83% (1055/1411)

- ACT – 86% (130/84)

- South Australia – 94% (165/411)

- Tasmania – NA (0/212)

- Western Australia – 50% (2/782)

- Northern Territory – 67% (3/26)

*(Auctions/Private Sales)

REVIEW(s) OF THE WEEK

Sale of our property

We have found Leigh to be open and professional in our dealings with him. He kept us informed at all times. Leigh made the effort to find out about our property and its attributes prior to inspections so that he could inform potential buyers We have no hesitation in recommending Leigh. – Seller

Honest, open, great communication

As a buyer, I have experienced nothing but integrity and great communication from Leigh. Yes, he works for the seller, however ultimately its a tripartite relationship and I’m super happy with our interactions. Highly recommend. – Buyer